Tax planning in 2021 will be a little different this year. As part of Xero’s Education Month, we are offering a webinar to give accountants and bookkeepers peace of mind as we head into April.

Tax planning in 2021 will be a little different this year. As part of Xero’s Education Month, we are offering a webinar to give accountants and bookkeepers peace of mind as we head into April.

Tax planning in 2021 will be a little different this year. As part of Xero’s Education Month, we are offering a webinar to give accountants and bookkeepers peace of mind as we head into April.

From better client relationships to faster data retrieval, we reveal the true strategic benefits of automated workflows – and why it’s so important.

This month, we’ve focused on enhancing our existing products on the Xero platform. Our teams use the ‘test, learn, refine’ principle to continuously improve the features you use every day, so you can streamline your accounting work and grow your business.

A recent article published in the Harvard Business Review by Bain & Co suggests that the pandemic has widened the productivity gap between top performing companies and others stating

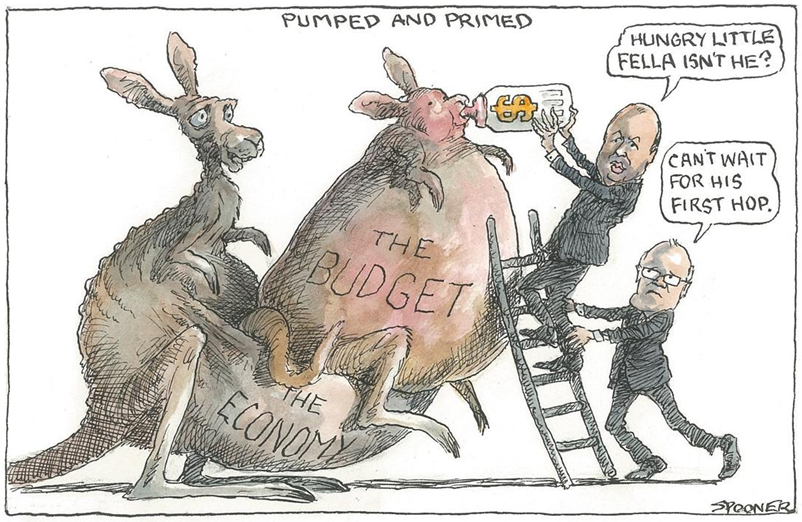

Fringe benefits tax (FBT) is one of Australia’s most disliked taxes because it’s cumbersome and generates a lot of paperwork. The COVID-19 lockdowns have added another layer of complexity as many work patterns and behaviours changed.

The first COVID-19 vaccination in Australia rolled out on 21 February 2021 preceded by a wave of protests. With the rollout, comes a thorny question for employers about individual rights, workplace health and safety, and vaccination enforcement.

Super Retail Group – owner of the Supercheap Auto, Rebel, BCF and Macpac brands – handed back $1.7 million in JobKeeper payments in January after releasing a trading update showing sales growth of 23% to December 2020.

There are still many unknowns ahead, but there are some things small businesses can start to plan for – these include a number of developments set to impact payroll in 2021.