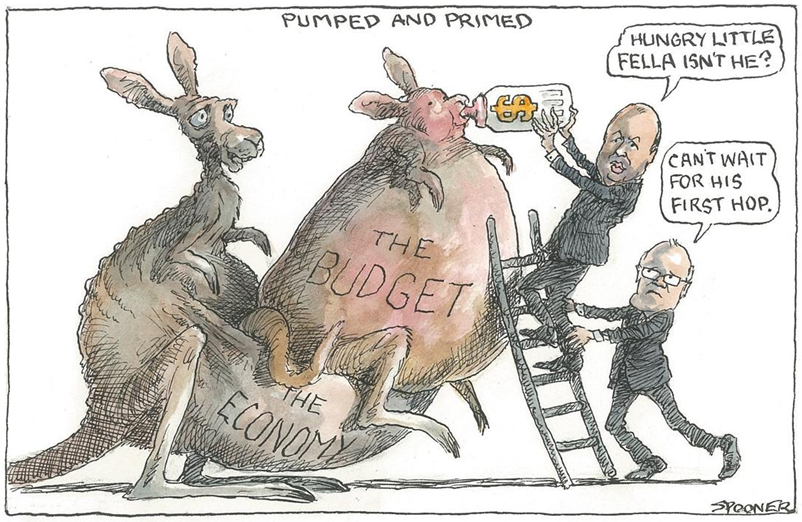

It’s a great headline isn’t it? Spend $100 and get a $120 tax deduction. Days after the Federal Budget announcement that businesses will be able to claim a 120% deduction for expenditure on training and technology costs, we started receiving marketing emails encouraging us to spend now to access the…

Our Blog

Industry news, articles and advice from the Delphi Accounting Group

What lockdown support is available1. (individuals all)2. NSW business3. Victoria (business and individual) What lockdown support is available1. (individuals all) If you can’t work because you or someone in your household is impacted by COVID-19, support is available. There are two payments accessible to individuals: the COVID-19 Disaster Payment; and, the Pandemic…

As we approach the end of the 2021 financial year, tax planning has never been more important and as accountants, we believe our client brief includes helping you minimise your tax liability within the framework of the Australian taxation system. The purpose of this newsletter is to highlight some end…

Tax planning in 2021 will be a little different this year. As part of Xero’s Education Month, we are offering a webinar to give accountants and bookkeepers peace of mind as we head into April.

Tax planning in 2021 will be a little different this year. As part of Xero’s Education Month, we are offering a webinar to give accountants and bookkeepers peace of mind as we head into April.

Tax planning in 2021 will be a little different this year. As part of Xero’s Education Month, we are offering a webinar to give accountants and bookkeepers peace of mind as we head into April.

From better client relationships to faster data retrieval, we reveal the true strategic benefits of automated workflows – and why it’s so important.

This month, we’ve focused on enhancing our existing products on the Xero platform. Our teams use the ‘test, learn, refine’ principle to continuously improve the features you use every day, so you can streamline your accounting work and grow your business.

A recent article published in the Harvard Business Review by Bain & Co suggests that the pandemic has widened the productivity gap between top performing companies and others stating

Fringe benefits tax (FBT) is one of Australia’s most disliked taxes because it’s cumbersome and generates a lot of paperwork. The COVID-19 lockdowns have added another layer of complexity as many work patterns and behaviours changed.